How do you determine the quality of your customer portfolio? And what can you say with certainty about the creditworthiness of your most important and largest customers? Simply assessing the outstanding balance does not tell you much about your buyer's financial strength.

Insight into customer portfolio quality

Understanding the quality of your customer portfolio is crucial for your daily debtor management, negotiations with existing and new customers and making strategic choices regarding your (future) working capital. For instance, if you are aware that there is a high probability that an important customer will be unable to meet its financial obligations in the foreseeable future, you can take timely action. That way, you will not be surprised by unexpected write-offs and lost sales. Valuable and price-setting information, in other words.

In addition, in your role as (potential) investor or portfolio manager, it is very important for you to have a good understanding of the quality of the debtors of companies you intend to invest in, or sell. This can help determine the buying or selling price of a participation or company.

Xolv, in collaboration with the world's leading credit insurers, has developed a number of risk analysis tools for assessing the creditworthiness of companies worldwide.

Xolv Risk Analysis tool

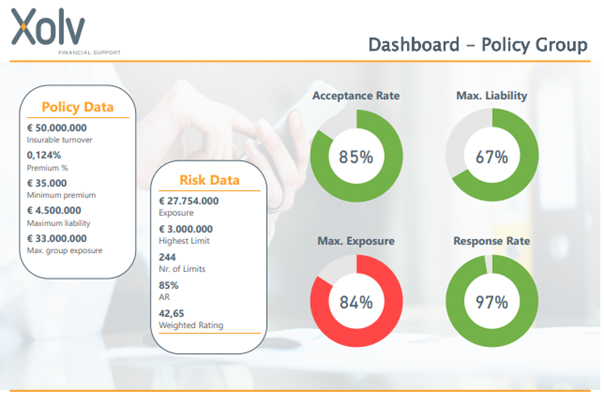

If you are already a customer of ours and use credit insurance, the Xolv Risk Analysis tool insight into current underwriting risks and effectiveness. We measure developments in, for example, the limit acceptance rate, (space in) the maximum total cover, the highest limits in relation to the maximum indemnity and the speed with which the insurer handles new cover requests.

In addition, do you use the PolisManager from our partner CreditDevice, then for even better insight into the analysis, we can also include trends in outstanding receivables and self-assessments.

Xolv X-Rays tool

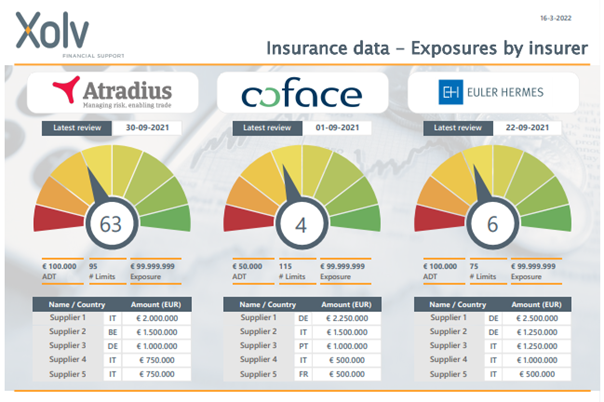

Do you not yet have credit insurance, but are still curious about insurers' opinions on your customer portfolio? Or are you an investor or financier looking for the right information to complement your due diligence of a potential investment or participation? If so, the Xolv X-Ray tool a comprehensive insight into the creditworthiness of the entire customer portfolio. By juxtaposing the risk ratings of multiple insurers, you get a more weighted impression of credit risks that might be invisible with a much narrower approach. You can also include things like turnover and outstanding receivables in this analysis to further expand the results.

Xolv X-Files tool

Do you use supplier credit yourself, or are you an investor or financier curious to know how creditworthy a potential investment or participation is? Then we can help you with our Xolv X-Files tool provide insight into how credit insurers value your (future) business. Through our direct contacts with insurers' risk and underwriting departments, we can provide an indicative overview of creditworthiness and underwriting policies. In addition, we guide you in any follow-up actions to remedy deficiencies. Perhaps the provision of information is not optimal, resulting in a (wrongly) negative assessment of a certain insurer. Or alternative solutions can be found that do allow coverage or reduction of credit risk for suppliers. These insights have a positive effect on your own negotiating position.

Conclusion

If you want insight into the quality of your customer portfolio, you can check the creditworthiness of your buyers with Xolv's risk analysis tools. This will give you an insight into trade and credit risks and help you protect your future cash flow. The perfect way to assess the creditworthiness of companies, or your future business, at any time.