Impact of Brexit on sterling

On 29 March 2019, the United Kingdom (UK) will leave the European Union (EU). Although it is not yet clear exactly what this will look like, that it will have consequences for the pound is almost certain. Three scenarios in a row.

No deal: hard hit for the pound

An exit without proper agreements in place, a so-called no deal Brexit, is the worst possible scenario. In this case, the borders between the EU and the UK will lock for people and goods overnight at the end of March 2019. This will have a huge impact on the UK economy and daily life. There is a danger, for example, that the health service will face a medicine shortage and supermarket shelves will be empty. If the negotiators actually make it to a Brexit without agreements, the pound will take a huge hit.

Hard Brexit: temporary share price pressure

With a hard Brexit, the borders also close, but it happens a lot less abruptly than with a no deal. In this case, both camps have reached good trade deals beforehand, which have also been approved by the UK parliament. As the UK loses access to the EU single market, British companies doing business on the Continent will have a tougher time, though. There is also a danger that many financial institutions will move from London to other European cities. It is likely that during the adjustment period, the UK economy will dip, putting temporary pressure on the pound.

Renegotiation: pound scratches some surface

The border between Ireland and Northern Ireland is the major stumbling block to a hard Brexit. The EU wants to keep this border open, but the British coalition is in danger of falling apart if Prime Minister Theresa May agrees to a scheme that requires the country to tightly control the internal border between Northern Ireland and the main island. The solution? Continue to negotiate and extend the existing agreements. The UK would then continue to pay money to the EU and adopt the rules, without being allowed a say in decision-making. This is pretty painful for the UK. Former foreign secretary Boris Johnson already shouted that the country would become a colony of the EU in this scenario. Looking at the main alternatives, however, this outcome is the least bad for the pound.

Impact Brexit for Dutch companies

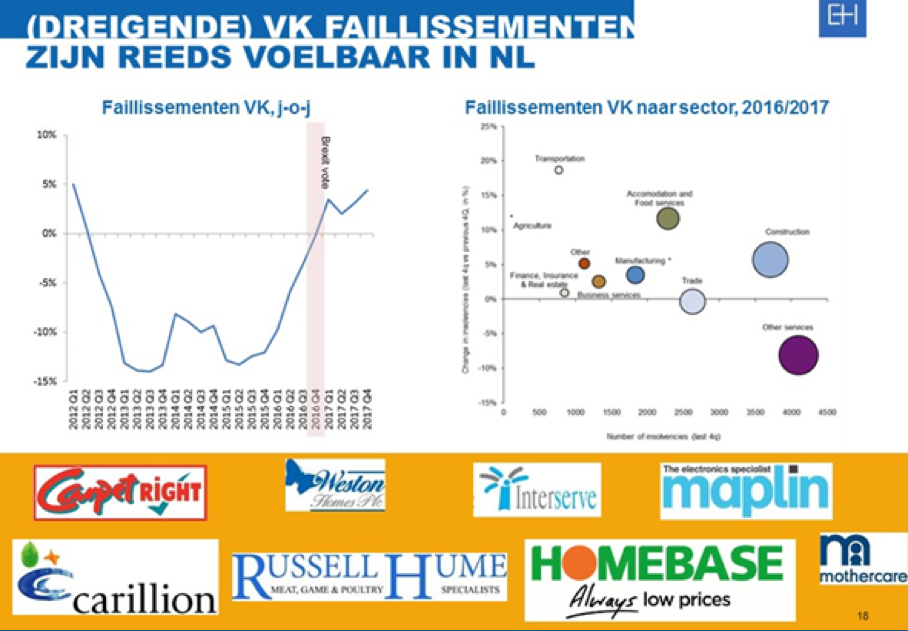

Whatever scenario will apply in the future, the impact of the Brexit is already huge. The charts below, made available by credit insurer Euler Hermes, show this. Chart 1 shows that the number of insolvencies in the UK is rising considerably. Chart 2 shows that the impact of the Brexit for Dutch companies exporting to the UK is substantial. In a worst-case scenario, a hard Brexit would cost Dutch businesses as much as EUR 30 billion.

Chart 1

Chart 2