Fluctuations

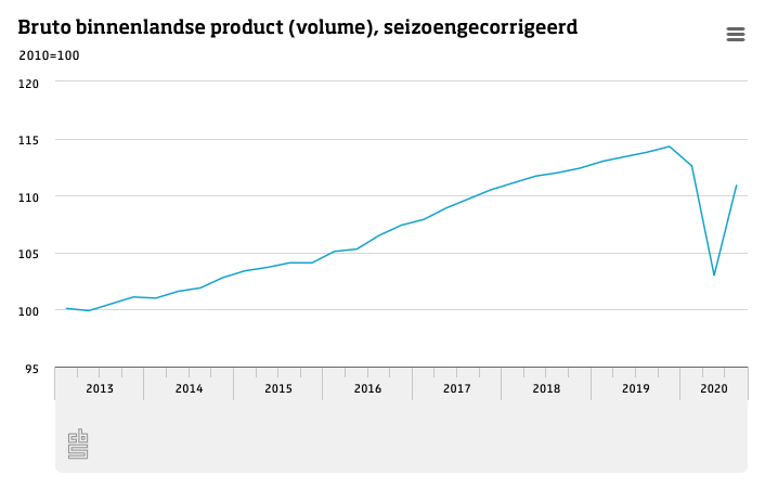

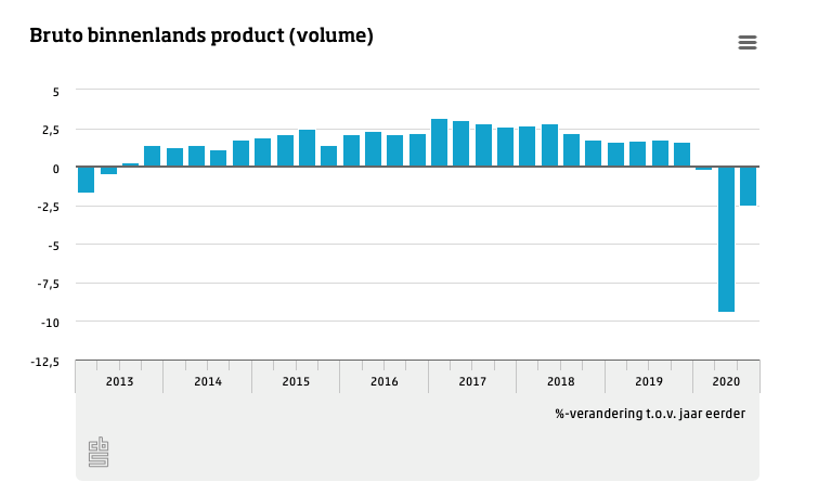

We are in a time of fluctuations. Not just in terms of emotions or what we are or are not allowed to do together. Above all, it is also a time of economic fluctuations. After the initial lockdown, the economy seemed to recover. According to CBS, the Gross Domestic Product (GDP) grew by a whopping 7.7% in the third quarter of 2020 compared to the second quarter 2020. It was the biggest ever growth, but of course there were also two historically low first quarters opposite.

And above all, let me remain realistic: the second corona wave and the associated partial lockdown will certainly be a negative effect have on the economy in the fourth quarter. Moreover, compared to 2019, the first three quarters of 2020 show an economic contraction of 3%. Exports contract, output falls, consumer prices rise, producer confidence and consumer sentiment fall. No happy news, then.

Figures create dilemma

Normally in situations like that, we see a decline in consumer spending. Now it is different; in particular, the spending on goods increases sharply. An extremely high number of houses are also being sold. Moreover, after the first lockdown, we saw that the economy quickly recovered. The hope (and perhaps expectation) is that the same will happen after this second lockdown. And then the number of bankruptcies: so far, that sits at 2019 levels, although it is expected to rise sharply in 2021.

Those 'positive' figures present credit insurers with a big dilemma. Should state aid - officially: the crisis measure reinsurance supplier credits - be extended in 2021? To date, claims levels at credit insurers are only a few percent higher than last year. And thus still low. So from that perspective, the government's support was unnecessary, you might say

Extension support

But there is a downside. This support has maintained credit limits on buyers affected by Covid-19. As a result, affected companies still have the much-needed supplier credit. More importantly, can they survive this crisis. Credit insurers are currently in talks with the government to extend the state aid. State Secretary of Finance Hans Vijlbrief has already indicated that he considers it necessary to extend the scheme until June 2021. (Tip: also read colleague Jeroen Ottevanger's blog on this!). Terms are still being negotiated with the three major credit insurers.

The primary interest of the aid is the maintaining coverage on farms. Secondary is the possible absorbing a huge increase in claims payments related to the expected increase in bankruptcies. A situation that could be exacerbated in the event of a no-deal Brexit. Companies must be given a chance to recover from the contraction in sales. Supplier credit will then be much needed. The third quarter of 2020 showed that the Dutch economy hugely resilient is. With this support, we will see the same in 2021. The CPB therefore expects the economy to recover again in 2021.

Supplier credit is the engine

One thing is clear as crystal to me: credit insurers will play an increasingly important role in business. Supplier credit is an important financing tool to keep the economy going. But it also carries risks. Companies provide financial information to credit insurers who are often able to hedge those risks, so suppliers can also provide supplier credit with peace of mind. An added advantage is that financiers are often able and willing to finance insured accounts receivable. This will help keep the economic engine going. And that's how we prevent the Dutch economy from being nailed down after all.

Paul van Uden - Managing director Xolv