Changes permanent?

A lot has changed and some of it will be permanent. Will we greet each other differently in the future? Will we soon go back to the office every day or will working from home become the norm? A year ago Teams-meetings were not commonplace for most of us, now they are quite normal. The way we do business ís changing and is likely to change permanently. The "new" way of doing business has many advantages: it makes us more efficient and partly solves traffic jams.

Reducing public debt

The Dutch government has pumped a lot of money into the Dutch economy to keep business running. Of course, that stops at some point. We will have to recoup that and that will take years. Business will also have to pay back some of the subsidies and tax deferrals. That is bound to cause problems.

Formation new government

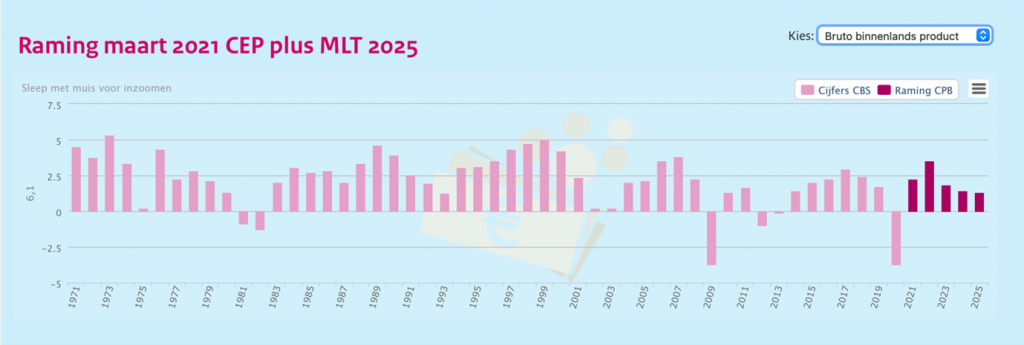

The recovery of the corona bill will have to be well managed by the government. We had hopes that a new government would be formed soon after the elections. VVD and D66 are the clear winners of the elections and on them rests the moral obligation to form a new government soon. Unfortunately, this has now been delayed by all kinds of political perils and a power struggle between parties. This certainly does not help the Netherlands or the economy. Instead of side issues, we should now 100% focus on recovery after corona, indeed, we should leave corona behind first. After the contraction of the Dutch economy of 3.8% in 2020, growth of 2.1% in 2021 and 3.7% in 2022 seems possible again. But then the government will have to resolve the restrictive measures quickly and the (new) government will have to act decisively.

Estimate Gross Domestic Product March 2021

(Central Economic Plan plus Medium-term forecast 2025)

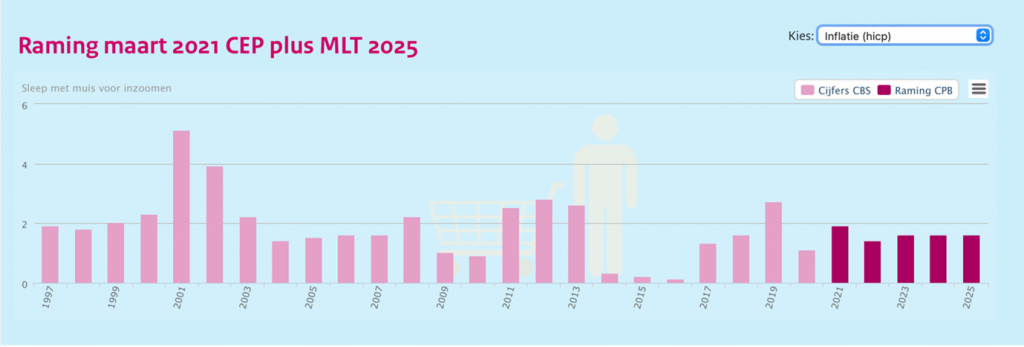

Estimate Inflation March 2021

(Central Economic Plan plus Medium-term forecast 2025)

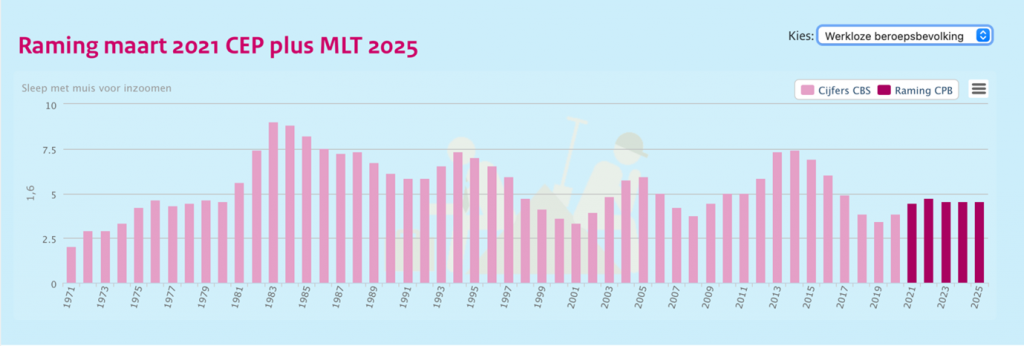

Estimate Unemployed labour force March 2021

(Central Economic Plan plus Medium-term forecast 2025)

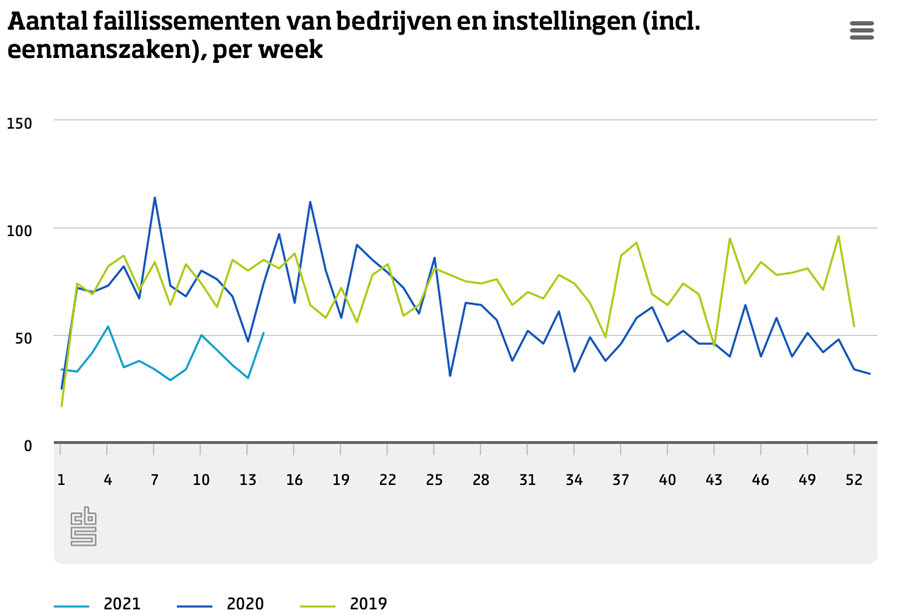

Increase in bankruptcies

Until the end of June, credit insurers are still using state aid that allows them to continue providing cover to companies affected by the Covid-19 pandemic. It is reasonably likely that they will no longer be able to use this support after the end of June. The number of insolvencies in 2020 has been relatively low, and because of the state aid, credit insurers have not made a profit for over a year. Because they now have a good grasp of the risks, they will want to take on the risks again. That means most of the cover on companies will remain in place. Nevertheless, a number of companies in bad shape will no longer get cover from credit insurers. This will undoubtedly lead to an increase in insolvencies. Perhaps there will still be a hybrid solution for a short period but eventually companies will have to stand on their own feet again.

Conclusion

Our way of working has changed because of the corona crisis. Whether this is permanent, time will tell. What we do know is that we have to earn back the money the Dutch government has pumped into the economy. This will take years. We hope the new government will act decisively in this respect. For now, we are especially curious about the effect on the end of government support and whether we will see an increase in bankruptcies in the coming year.