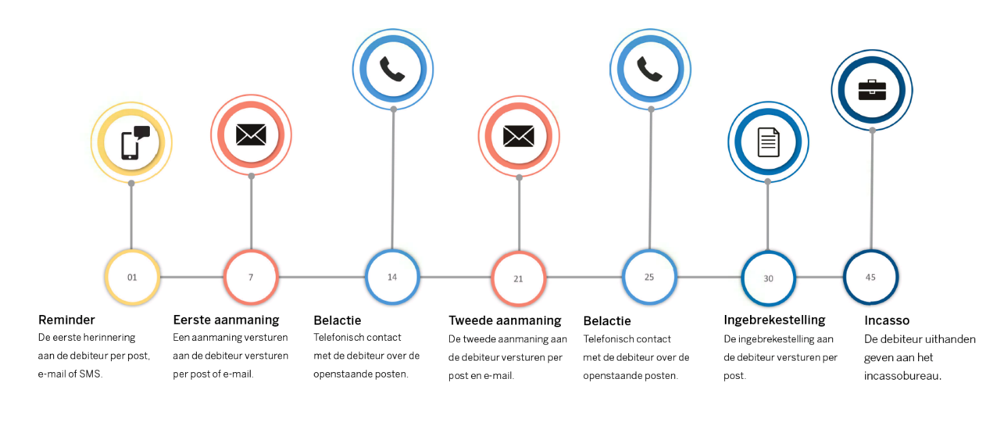

First, the basics of the receivables management process:

The benefits of credit management software

- Greater control and tight monitoring of receivables management (process optimisation);

- Extra focus for customers who need more attention;

- Clear overview of the complete dunning process;

- More effective and faster communication with debtors (as well as internally);

- Form of communication customisable at customer level which increases your customer experience;

- Invoices are paid faster (so you can include a payment link to the customer);

- Easy to run reports.

Moreover, a policy manager ensures that the credit controller knows exactly what to do when. This ensures that the rules of an insurance policy are applied correctly and you do not run the risk of a self-assessment being withdrawn or credit limits being exceeded.

All in all, plenty of reasons to think concretely about credit management software. After all, more efficient and effective accounts receivable management leads to better cash flow and healthy operations. It serves the performance of your business increasing growth opportunities.

Want to know more about what credit management software can do for your wallet? Then contact us at info@xolv.nl or 073 - 820 02 95. Our specialists will be happy to talk to you.

Source: CreditDevice